Budget: How to Save Money This Month + free downloads!

Budget: How to save money this month+free worksheets!

Budget Worksheet

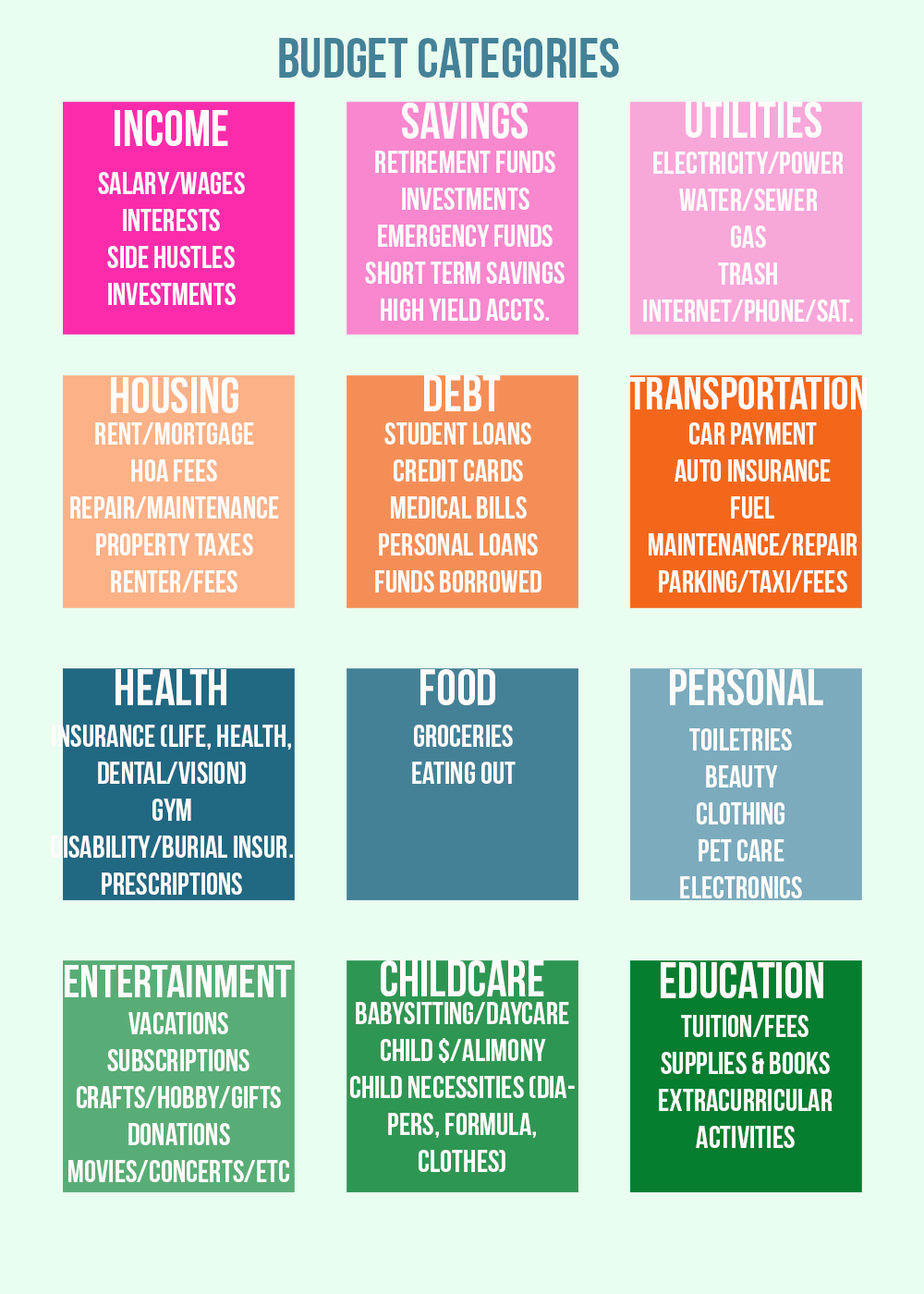

FREE download for you! Feel free to make it your own! this is just a basic spreadsheet to help you organize your income and expenses, don’t forget to reference the budget category sheet below for a LARGE list to add to your personal worksheet!

Below are a few books that motivated me to learn more about money! Do you have any favorites?

How to budget for personal and business growth and feel good about where your money is going while doing it like a boss! As promised in the podcast, download the worksheet (either for PC or MAC) to start telling your money where to go and learn how to manage an easy to do budget.

Start with fixed expenses and then add in the items that change with each month.

This topic isn’t for entrepreneurs alone, although it’s a great way to see in no uncertain terms how much money you need each month for just the basics of living before you jump into full time entrepreneurship or maybe even start to pay yourself, if you haven’t begun to do that in your side hustle. It’s for every single person. That’s right, tons of money or low income, you should have an idea of what you’re really spending money on.

Want to start saving more this month?

1- Look for a savings account with a high yield interest, this will allow you to make money on the money that’s just sitting in your account. And If you don’t have a separate account for savings, it’s a must. We tend to spend within our budget, out of sight out of mind for bigger emergencies or saving for something later down the line.

2- Limit going out to eat, coffee shop stops, and all those little purchases. Try cutting down to once a week or date night dinner. it’ll save you hundreds (depending on how often you go out to eat now) Groceries may seem like a bigger expense upfront, but it’s been proven that not only is buying groceries less expensive, but it’s healthier and can go further for meals.

3-Allow for fun activities, i know you may not have expected that, but allowing yourself time with people to be flexible along with your budget (even if it’s $50-100) can help you stay on track because you’ve allowed for that wiggle room.

4- Investment. This is a WHOLE different subject, but i suggest reading and researching which investments work best for you and your family’s budget.

It might seem like just another to do for a budget to keep up with, but it’ll allow you to think less about money when you know exactly what you’re doing with it. Do it for 6 months to learn your habits inside and out and adjust accordingly.

ONE more thing- if you’re here and you own a business- Hire a CPA and accountant. if there’s something i’ve learned, it’s i don’t know it all, and i don’t have to. They can be as involved as you need even if you’re not making money yet in your side hustle, and make a huge difference so you’re doing taxes correctly and can leave brain space for more important things, like your services or product.

First having a separate savings account is a must. If you have it under checking, you won’t see that number go up. We tend to live in (or over) the budget we have. So having a separate account that you don’t actually touch unless you absolutely need it, is best. think keep checking low, keep savings high. I suggest keeping in your checking a little extra in case of emergencies that you can’t immediately get to your savings account, but anything much over- push it over to savings.

living under your means. One reason for the savings account separate is we tend to see money in the account and use it. if it’s separate you’re paying your future self and living within your means and fully understanding where your money is going.

Now it might just seems like another to do list on your already maxed out brain power of the day that already slips by, but your money is important and to have money not be a constant worry, stress free. You’ll be more free to use it for you, know confidently when you can do fun activities, and once you start saving, feel like theres money when life throws the not so fun expenses your way. This isnt’ to say you can’t stop doing it for a while.. let me explain. I suggest doing for at least 6 months. adjust your numbers, get everything down, and work towards tightening it up. it’ll become more intuitive the longer you do it, and then if you forget to track for a couple months, it’s okay.. come back to the worksheet to adjust again, tighten, change and see the progress.

i do have to make a statement about married couples. Although either spouse can handle the money, more often than not the man handles the money- i am seriously advising against not having a hand in finances. Learn where your money is going. this doesn’t mean you even have to look every single time he sits down, but learn it. Not only should you learn in case anything happens health wise but also because as part of the team you could have fresh eyes of where a budget can be pulled in tighter. I think every single womens finance book mentions this and i cannot stress enough- learn your finances. even if your. spouse is a money wiz.

To hear more in depth explanations listen to the podcast above!

Keep Shining

![[032020]-1004.png](https://images.squarespace-cdn.com/content/v1/52b4e622e4b09ec38d13e690/1586387467069-B9NVY7ZWA05XBQE94114/%5B032020%5D-1004.png)